Most Consumers Support Building New Housing but Disagree on the Details in Their Own Neighborhoods

When surveys ask consumers whether they support the general concept of building housing to create more affordable buying opportunities or help lower rents, most agree.1, 2 However, to our knowledge, no prominent surveys have asked consumers whether they support the construction of more homes in their own neighborhoods (defined as within a few blocks or streets of their home address).

To answer that question — and many others — we turned to our National Housing Survey®. We specifically asked consumers for their perspective on increasing housing density and zoning in their actual neighborhoods, including the expected impact on local home prices, rents, and taxes, and the types of housing supply they're most likely to support. The survey also compared homeowners' and renters' perspectives on whether housing density should increase — and in what ways.

Key findings:

- Far more consumers today say affordable housing is difficult to find than when we first asked the question in 2017, owing to significant increases in home prices and mortgage interest rates.

- Significantly more renters than homeowners support building affordable housing in their own neighborhoods. And renters are much more likely than owners to support building denser housing types, such as townhomes, apartments, or condos.

- More than half of consumers believe home prices, rent prices, and local taxes will increase if more homes are built in their neighborhood, which we found particularly interesting because it opposes the traditional economic argument that increasing supply lowers prices.

Despite Agreeing on Unaffordability, Renters and Homeowners Often Strongly Disagree on Potential Solutions

As expected, consumers are much more likely to say affordable housing is difficult to find today (69%) than they were in our 2017 survey (49%) — but the 2024 share is essentially unchanged since late 2021. Since the pandemic, consumers have dealt with several years of elevated home prices and sharply rising mortgage rates, which have led to an extraordinarily challenging home purchase market.

When asked to consider the possible solution of building more housing in their neighborhood to ease affordability challenges, there is a clear difference in sentiment between homeowners and renters. While our survey found that most consumers (82%) are in favor of building some type of new housing in their neighborhood, when we asked them specifically about building more "affordable" housing, renters were significantly more likely to be in favor than homeowners (73% vs. 44%).

Furthermore, while homeowners and renters are both likely to support building additional single-family detached homes in their neighborhood, renters are much more likely to support building other housing types, such as townhomes, apartments, or condos.

And when asked if they would support changes to local zoning codes or regulations to allow more housing development, nearly two-thirds of renters (63%) say they are in favor, while just 37% of homeowners say the same — another clear point of contention between the two groups that often plays out at local government meetings.

Consumers Aren't Convinced New Supply Will Improve Housing Affordability

While most economists agree that building more homes will help slow price appreciation for buying and renting, consumers are less convinced. In fact, 59% say they believe home prices will increase in their neighborhood if more homes are built, while just 13% say home prices will decrease. One possible explanation for this discrepancy may be that many assume the homes being built would not be what they consider affordable.

Moreover, a slight majority of consumers (59%) think rent prices will increase if more homes are built, and 61% say local taxes will increase — showing additional perceived financial drawbacks of new construction.

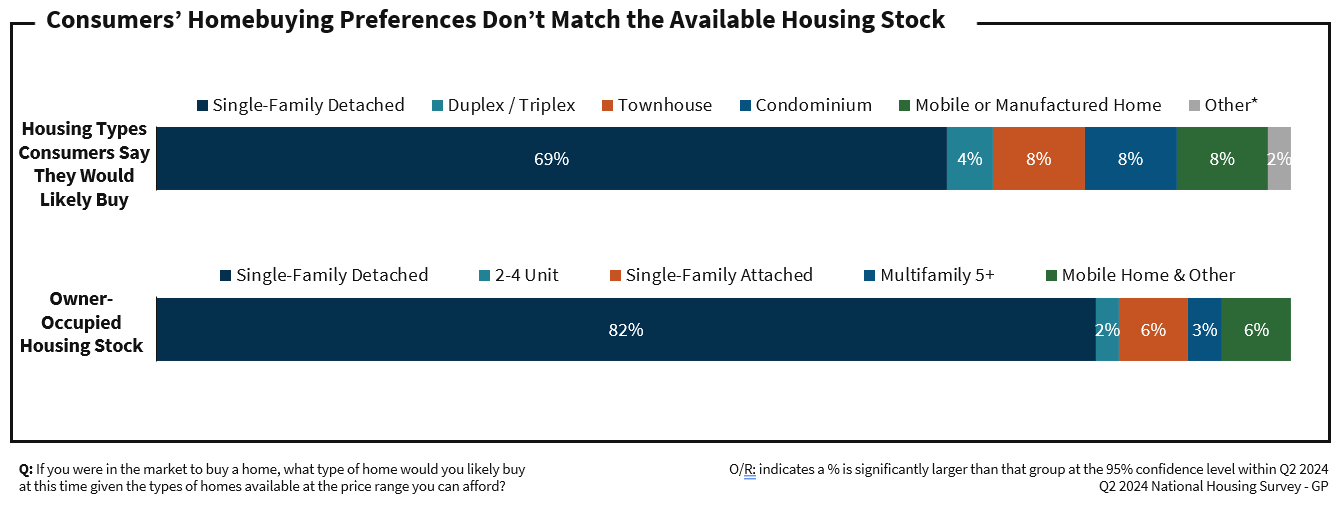

Consumer Demand for Housing Types Doesn't Match What's Available

When we look at the types of homes that consumers say they would likely buy if they were in the market (given what is available and what they can afford), roughly one-third of consumers (31%) say they would buy something other than a single-family detached home.

However, we know that non-single-family detached homes represent only 18% of the housing stock mix. Clearly, consumer demand for this particular housing type appears to far outstrip supply, which we think could have important implications for homebuilders.

Click image above for larger view

Mixed Consumer Sentiments Could Make New Development Challenging

Consumers' mixed sentiments on housing affordability and construction could make it challenging for policymakers and homebuilders to agree on reforms and proposed developments. Consumers clearly understand the need for greater affordability, but most don't support the development of housing types in their own neighborhood that most experts believe would have the greatest positive impact on affordability.

However, when survey respondents considered the broader effects of new development, they believe more housing is a net positive. The survey results also suggest greater pent-up homebuyer demand for denser housing types than what currently exists in the housing stock, pointing to a potential need for additional supply.

To learn more, read the full research deck.

Opinions, analyses, estimates, forecasts, beliefs, and other views of Fannie Mae's Economic & Strategic Research (ESR) Group or survey respondents included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, beliefs, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, beliefs, and other views published by the ESR Group represent the views of that group or survey respondents as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.

2 Zillow: https://www.zillow.com/research/missing-middle-affordability-32711/