History

Fannie Mae transformed homeownership in the U.S. with the introduction of the 30-year, fixed-rate mortgage loan.

In the early years of the 20th century, homeownership was a cherished dream for many families. Yet without the long-term, fixed rate mortgage most homeowners have today, saving for a down payment was tough, loans were short-term, and large balloon payments awaited when those notes came due.

During the Great Depression, nearly a quarter of the nation’s homeowners lost their homes to foreclosure. Banks simply didn’t have the funds to make mortgage loans. To address the situation, the United States government created Fannie Mae and charged it with the mission it continues to serve today: to provide liquidity, stability, and affordability in the mortgage market.

Fannie Mae helped banks finance a new type of mortgage: the long-term, fixed-rate home loan. The innovative mortgage loan expanded access to affordable homeownership, offered homeowners more certainty about their monthly mortgage payments, and transformed the housing industry.

At Fannie Mae, we continue our mission to help make stable, efficient, and affordable mortgage loans available in the United States. We strive to be America’s most valued housing partner by maintaining responsible risk management for sustainable housing finance and leading with innovative mortgage solutions.

U.S. Congress Creates Fannie Mae in Franklin D. Roosevelt’s New Deal

During the Great Depression, there was a recognized need for a reliable, steady source of funding for housing. At the time, affordable mortgage credit was inaccessible for many families.

Helping Our Heroes Buy Homes

Fannie Mae financed home purchases for millions of American soldiers returning from World War II. The nation’s economy grew rapidly and the liquidity Fannie Mae provided allowed mortgage lenders to have the cash on hand to meet the demand.

Growth and Prosperity

Homeownership grew throughout the country during the second half of the 20th century and fueled the rise of the middle class. The Charter Act reorganized Fannie Mae from a government agency into a mixed ownership corporation in 1954.

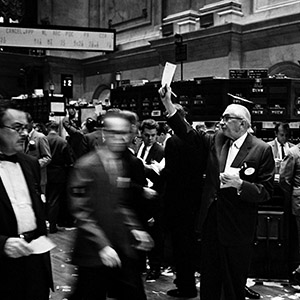

Bringing Wall Street to Main Street

In the 1968 Housing and Urban Development Act, Fannie Mae became a private shareholder-owned corporation chartered by the U.S. Congress. After being removed from the federal budget, Fannie Mae funded its operations through stock and bond markets.

A World of Opportunities

In the 1980s, the development of mortgage-backed securities brought capital from global markets to the U.S. housing industry. Fannie Mae securitized mortgage loans and guaranteed payment to investors, which it continues to do today.

Crisis and Conservatorship

Housing prices plummeted and delinquencies rose during the financial crisis, and the government-sponsored enterprises lost billions of dollars on investment portfolios and mortgage-backed security guarantees. The federal government put Fannie Mae and Freddie Mac under the conservatorship of the Federal Housing Finance Agency.

The Heart of Housing

The company returned to profitability in 2012. In 2014, Fannie Mae had paid back all funds it received when it first went under conservatorship and has since put billions into the U.S. Treasury.