Consumer Mortgage Understanding Study

In 2015, 2018, and again in 2023, Fannie Mae conducted a consumer survey that uncovered opportunities to close knowledge gaps around mortgage qualifications and underscored the need to continue to improve the mortgage process. While consumer knowledge of what it takes to qualify for a mortgage is mixed, Fannie Mae and the industry can help close the knowledge gap by making the mortgage process more intuitive and leverage underwriting innovations to make the dream of homeownership a reality.

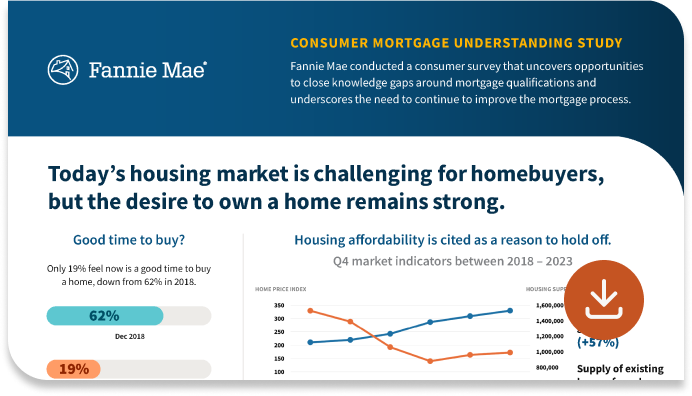

Today’s housing market is challenging for homebuyers, but the desire to own a home remains strong.

Housing affordability is cited as a reason to hold off.

Why affordability is cited as the reason to hold off

- High mortgage rates

- High home prices

- Unfavorable economic conditions

Good time to buy?

Only 19% feel now is a good time to buy a home, down from 62% in 2018.

of consumers think it would be very or somewhat easy to get a mortgage

Median household income

30-year fixed mortgage rate

Consumers still believe in the dream of homeownership.

Consumer knowledge of what it takes to qualify for a mortgage is mixed.

Most consumers have an understanding of their credit, and it’s grown since 2015.

And significantly more are using credit monitoring services.

Knowledge gaps persist when navigating the mortgage process, creating extra hurdles to buying a home.

Three major challenges

- Lack of confidence navigating the mortgage process

- Overestimating minimum down payment required

- Overestimating minimum credit score required

Consumers rely most on housing industry professionals, including real estate agents, lenders, financial planners, and counselors for mortgage advice.

Many homebuyer resources and programs are available.

Here are a few from Fannie Mae.

Affordable mortgage options

Loans that allow for down payments as little as 3% like HomeReady® Mortgage.

Make rent count

A solid record of consistent rent payments may help you qualify for a mortgage, even if you have a limited credit history.

HomeView®

Comprehensive free first-time homebuyer course — in both English and Spanish.

Calculators and checklists

Robust set of free tools helping to estimate down payment assistance, monthly mortgage payments, closing costs, and more.