Learn about our business

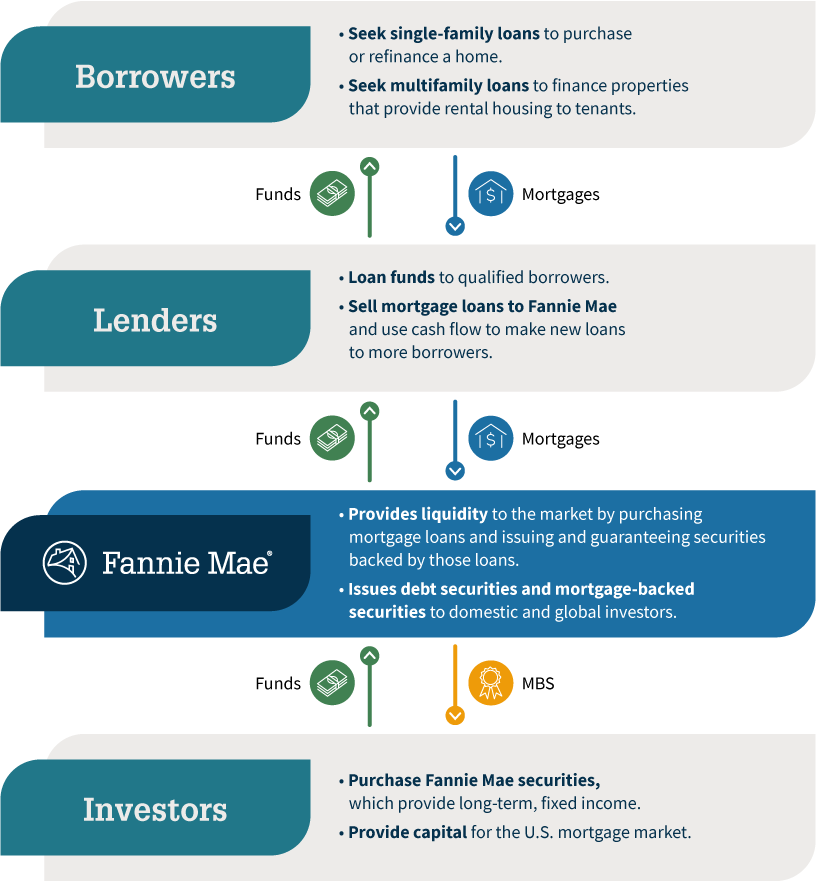

Fannie Mae is a leading source of mortgage financing for single-family and multifamily mortgage lenders in the United States. Our Charter is an Act of the U.S. Congress, which enshrines in law our purpose to provide liquidity and stability to America's housing market and to promote access to affordable mortgage credit in communities throughout the country. Our work helps lenders offer affordable mortgage loans, like the 30-year, fixed-rate mortgage, to low- to moderate-income homebuyers and homeowners, and promotes access to safe, quality housing for renters. In 2023, we provided $369 billion in liquidity to the U.S. mortgage market, which enabled the financing of approximately 1.5 million home purchases, refinancings and rental units.

Since September 6, 2008, Fannie Mae has been under the conservatorship of the Federal Housing Finance Agency, which provides supervision, regulation, and housing mission oversight. More information can be found in our 2023 Form 10-K.

We are dedicated to the safety and soundness of the housing finance system, which requires that we ensure the sustainability of our business and focus on meeting the needs of borrowers, renters and the lenders who serve them.

We do not originate loans or lend money directly to homebuyers or multifamily property owners. The lenders we work with originate mortgage loans to qualified borrowers and sell loans that meet our standards to us so they have capital to continue lending to more borrowers. Fannie Mae securitizes the loans we purchase into mortgage-backed securities (MBS), which are sold to investors around the world. Our MBS investors know they will receive timely payment of principal and interest, because of our guarantee. We earn guaranty fees for assuming the credit risk on loans underlying our MBS.

2023 by the numbers

Provided $369 billion in liquidity to the U.S. mortgage market

Enabled financing of approximately 1.5 million home purchases, refinancings, or rental units.

Financed approximately 482,000 multifamily rental units

A significant majority of which are affordable to families earning at or below 120% of Area Median Income, providing support for both workforce and affordable housing.

Acquired approximately 805,000

single-family home purchase loans.

Financed approximately 179,000

single-family refinancings.

Earned $17.4 billion in net income

See Fannie Mae 2023 Form 10-K for more details.

Managed guaranty book of business

Totaling $4.1 trillion (as of year-end 2023).

See Fannie Mae’s 2023 Year-End Results/Annual Report on Form 10-K and the Annual Housing Activities Report and Annual Mortgage Report.