Leveraging Variable and Gig Income to Expand Access to Homeownership

Ensuring a potential borrower has a steady income source that allows them to repay their mortgage loan is critical to supporting sustainable homeownership — and is one of the most important aspects of underwriting. With the rise in both home prices and interest rates, leveraging all eligible income sources could help a borrower receive an approval for their mortgage loan and transition to homeownership.

The complexity of analyzing a borrower's income to ensure it is stable and likely to continue can range from more straightforward scenarios, such as for salaried workers earning a consistent amount month to month, to more involved, such as for hourly workers earning a fluctuating amount each month. In these variable-income situations, it may be more difficult to calculate a monthly income amount that a borrower can consistently rely on in the future.

Two types of fluctuating income are of key interest1: variable income earned by being employed through hourly pay with fluctuating hours, commissions, bonuses, and overtime pay; and digital gig economy income earned by performing tasks or services through a digital platform, such as a rideshare company. Given the growth of these income types2 post-pandemic, we surveyed nearly 200 senior mortgage executives via our Mortgage Lender Sentiment Survey® in early October 2024 to gather lenders' views and experiences assessing variable and digital gig economy income for mortgage lending.

Among the key findings:

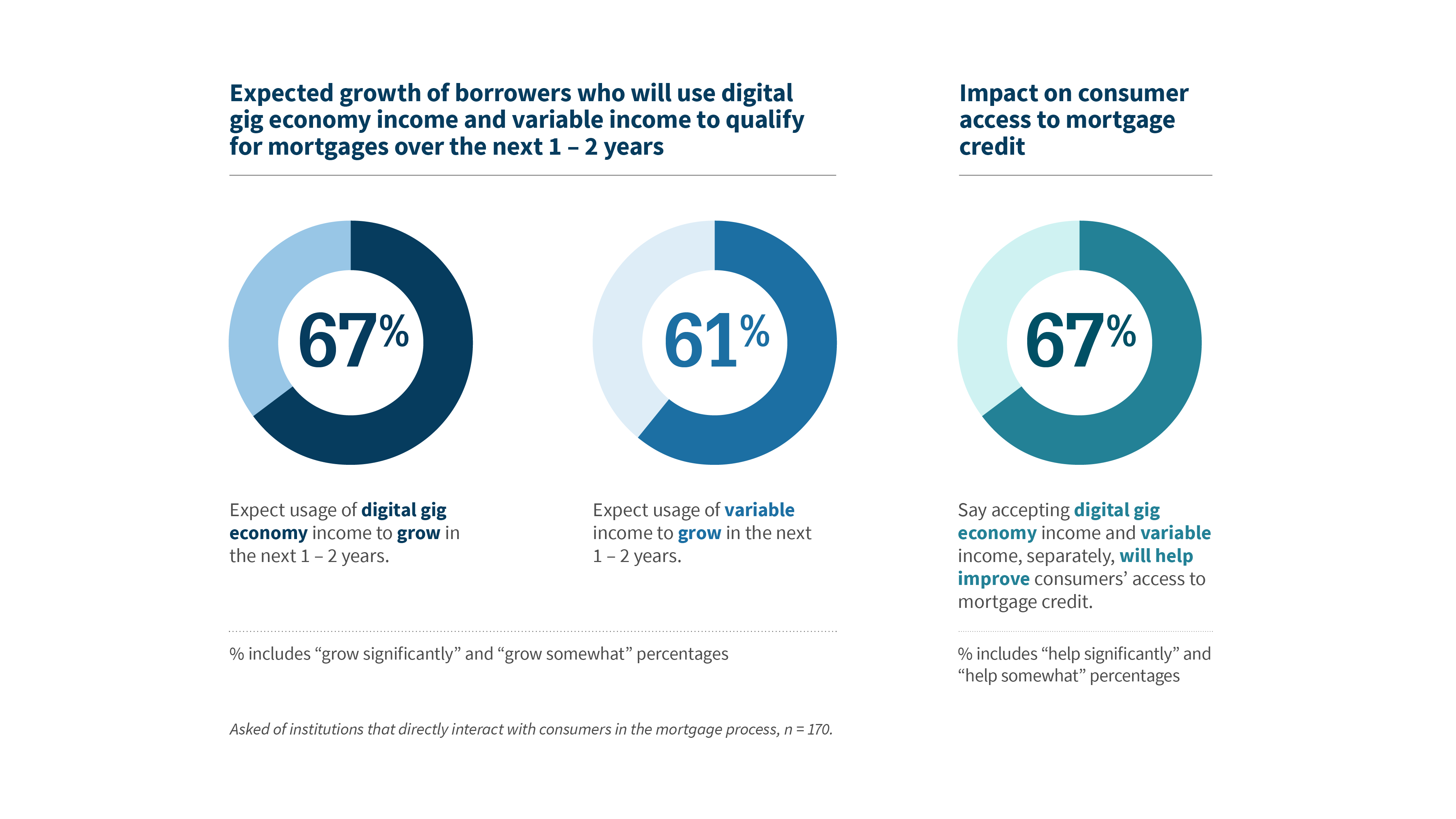

- Most lenders (67%) believe that accepting digital gig economy and variable income will improve consumers' access to credit.

- Nearly half of lenders say the number of borrowers who use digital gig economy income and variable income, separately, to qualify for a mortgage has grown in recent years. Most lenders expect this growth to continue over the coming years3.

Click image above for larger view

- However, many lenders noted these income sources are difficult to use in approving borrowers' mortgage applications (83% for digital gig economy income and 71% for variable income)4, primarily because of challenges related to the income history and stability requirements, income calculation, documentation requirements, and limited industry standards or investor guidelines.

Click image above for larger view

- Lenders' perspectives on current underwriting guidelines from secondary market investors are mixed.

- With digital gig economy income, nearly half of lenders (46%) prefer the guidelines to be more detailed (or more prescriptive), while 29% say the current guidelines are "about right" and 26% prefer the guidelines to be more flexible.

- With variable income, about 44% of lenders found the guidelines "about right,5" with nearly one-third (32%) saying they are not detailed enough and nearly one-quarter (23%) saying they need to be more flexible.

Click image above for larger view

These survey results highlight lenders' views on the job market, including their observation that more borrowers are earning variable and gig economy income. While current industry guidelines may serve these borrowers, there is a need for more prescriptive policies from secondary market investors, in particular, for assessing digital gig economy income. Fannie Mae provides access to several tools that assist lenders in their evaluation of complex income scenarios, including our free Income Calculator tool. Mortgage professionals can use Income Calculator to evaluate income from self-employment, including gig economy income, and rental properties.

As these types of jobs continue to grow, leveraging new technologies and data sources will play a key role in building sustainable underwriting practices that balance access to credit with prudent risk management. Unlocking further the potential of variable and digital gig economy income could achieve broader access to home financing and expand homeownership opportunities to more Americans.

To learn more, read the full research deck.

Opinions, analyses, estimates, forecasts, beliefs, and other views of Fannie Mae's Economic & Strategic Research (ESR) Group or survey respondents included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, beliefs, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, beliefs, and other views published by the ESR Group represent the views of that group or survey respondents as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.

1 Here are the definitions used in the survey:

Variable Income: Borrowers earn income by working as an employee for an employer, but the amount of income earned varies. It typically includes hourly pay with fluctuating hours, commissions, bonuses, and overtime pay. This income is reported on IRS Form W-2.

Digital Gig-Economy Income: Borrowers earn income by performing tasks or services through a digital platform (e.g., Uber, DoorDash, & TaskRabbit). This type of income is typically reported on IRS Form 1099 and borrowers file tax returns indicating they are self-employed (Schedule C).

2 U.S. Census, based on the American Community Survey, estimates there are 490,000 digital gig economy workers in 2021, up from 367,000 in 2018, https://www.census.gov/content/dam/Census/library/working-papers/2023/demo/sehsd-wp2023-13.pdf

According to Bank of America Institute, the share of Bank of America customers who received income from gig platforms through direct deposits or debit cards was above 3.8% in March 2024, surpassing the previous peak that occurred in early 2022, https://institute.bankofamerica.com/content/dam/economic-insights/consumer-morsel-gig-economy-is-up.pdf

3 Mortgage banks (19%) are significantly more likely than depository institutions (6%) to say they expect usage of digital gig economy income to grow significantly in the next 1-2 years.

4 Mortgage banks (81%) are significantly more likely than credit unions (55%) to say that it is difficult to use variable income sources to approve a mortgage.

5 Mortgage banks (32%) are significantly less likely than credit unions (66%) and depository institutions (54%) to say that current guidelines for using variable income are "about right."