Mortgage Lenders Cite Operational Efficiency as Primary Motivation for AI Adoption

Businesses are increasingly leveraging digital technologies to reduce errors and costs, speed up transactions, and drive enhanced and better customer service. Over the past decade, artificial intelligence (AI), including machine learning (ML), has gained traction among businesses across a variety of industries.1 In the mortgage industry, potential areas of AI/ML application include automating and streamlining manual processes, detecting fraud and data anomalies, assessing and managing risk, predicting loss/default, and analyzing customer behaviors to improve communication and personalization.

In 2018, Fannie Mae surveyed senior mortgage executives via its Mortgage Lender Sentiment Survey® (MLSS) to better understand lenders' views on AI/ML, including adoption interests and barriers2. This year, amid wider societal discussion of the still-nascent technologies, we re-surveyed mortgage lenders to assess how their views and experiences with AI/ML may have changed.

Despite the growing ubiquity of AI/ML, we found that mortgage lenders' familiarity, current adoption status, and adoption challenges with the technologies have remained largely unchanged over the last five years. Specific findings of the 2023 survey include:

- Nearly two-thirds of lenders (65%) in 2023 said that they are familiar with AI/ML technology, consistent with 2018 (63%).

- Regarding adoption status, significantly fewer lenders in 2023 (7%) than in 2018 (14%) said they have deployed AI/ML. However, a significantly greater share said they have started deploying AI/ML in a limited or trial basis (22% in 2023 vs. 13% in 2018). Additionally, in the most recent survey, fewer lenders (29%) indicated that they expect to roll out AI/ML tools more broadly in the next two years compared to 2018 (38%).

- Among lenders who have not used AI/ML technology, the biggest barriers to adoption in 2023 remained the same. These include integration complexity with current infrastructure, lack of proven record of success, and high costs. Mortgage banks are more likely than depository institutions to cite integration complexity as a serious challenge. Data security and privacy concerns have also grown significantly since 2018.

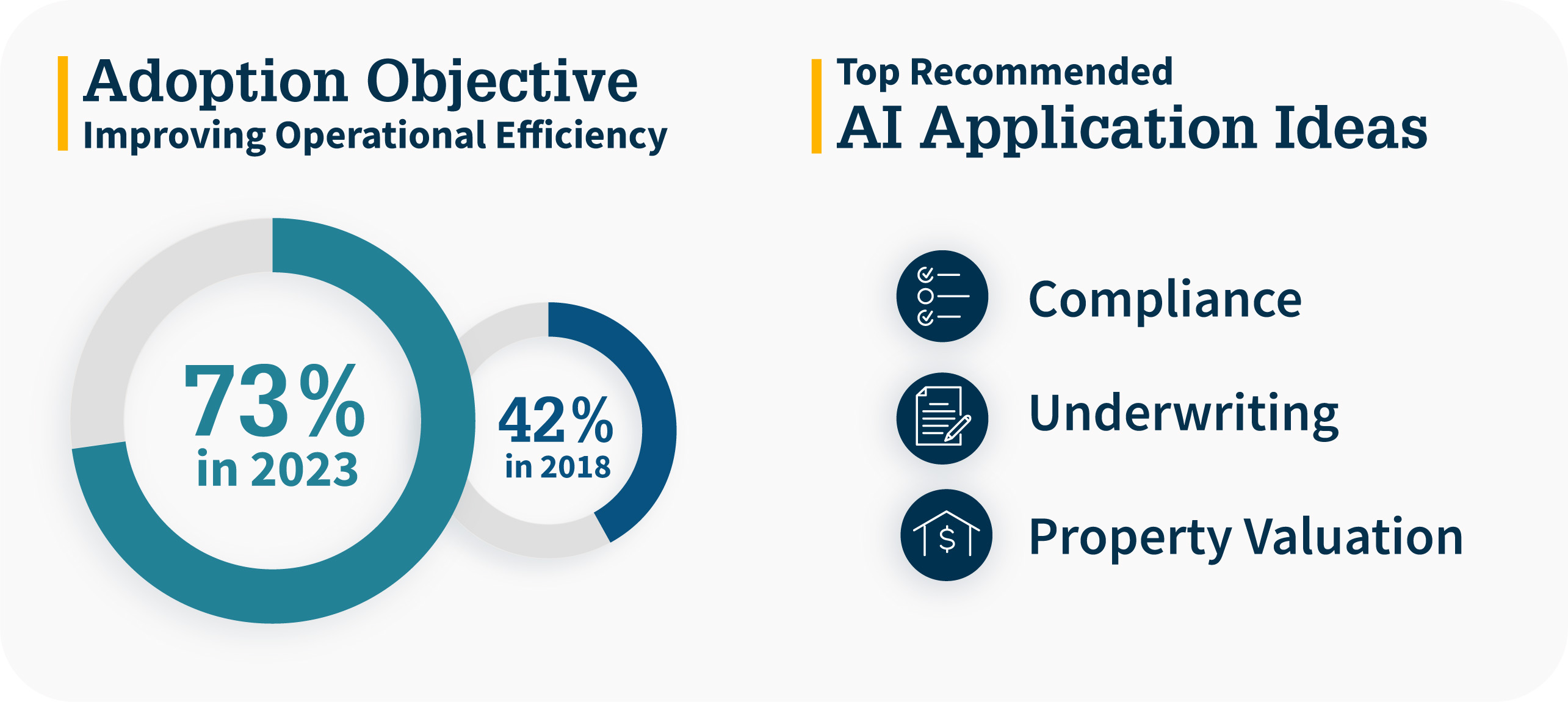

- This year, lenders overwhelmingly cited improving operational efficiency as the primary motivation behind adopting AI/ML (73% in 2023 vs. 42% in 2018). The use case of enhancing the consumer/borrower experience faded significantly as a top reason (7% in 2023 vs. 41% in 2018).

- Among the seven ideas tested in the survey3, using AI systems to automate compliance review was the most appealing to lenders, especially for depository institutions. The second-most appealing idea was anomaly-detection automation to help identify fraud or defects early in the underwriting process. When asked to recommend AI application ideas for the GSEs to develop for the mortgage industry, lenders pointed to appraisal automation, borrower income/employment verification, data/documentation reconciliation and standardization, and compliance management.

These survey results showed a clear shift in AI priorities and paint a more grounded picture of how AI might be leveraged among mortgage origination firms in the near and intermediate term. The mortgage industry consumes immense quantities of data from a wide variety of sources; this is a natural pain point for industry participants across the value chain. The latest results indicated that lenders most value AI applications that might help automate this sort of data processing and identify potential anomalies. Given the rising costs of today's business environment, AI applications intended to improve operational efficiency are clearly highly valued by lenders and could function as a starting point among industry stakeholders to encourage wider adoption.

Over the years, lenders have stressed the importance of the "human touch" in the mortgage business, particularly as it pertains to customer interactions. For their part, consumers have expressed a similar preference for human involvement during much of the home purchase process, which, for many, represents the largest financial transaction of their lives. As such, it doesn't surprise us that lenders placed a lower value on potential AI/ML applications that automate or assist the tasks that have typically required human interaction, and even indicated little expectation that AI might replace or displace their employee base. It's possible, too, that existing contractual agreements between lenders and third-party vendors may be limiting AI/ML adoption; and there may even be hesitation among mortgage lenders to leverage the new technology due to apprehensions about the handling of private or sensitive information. Regardless, as these technologies mature, we expect humans and AI/ML to play to their respective strengths within the mortgage industry, with the latter likely to handle more of the back-end processing and the former continuing to build and maintain the customer relationships necessary to drive sales.

To learn more, read our Fannie Mae Mortgage Lender Sentiment Survey Special Topic Report, "Artificial Intelligence and Mortgage Lending."

The author thanks Stephen Gilbert, Mazin Rayes, Jolene Lester, Steve Deggendorf, Doug Duncan, Mark Palim, Matt Classick, and Li-Ning Huang for valuable contributions in the creation of this commentary and the design of the research. Of course, all errors and omissions remain the responsibility of the author.

Opinions, analyses, estimates, forecasts and other views reflected in this commentary should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Changes in the assumptions or the information underlying these views could produce materially different results.

1 Artificial Intelligence (AI) performs tasks that mimic human intelligence, such as visual perception, speech recognition, language translation, and reasoning and decision-making (e.g., chatbots and virtual assistants). AI with machine learning (ML) capabilities also have the ability to process large amounts of data (structured and unstructured) from various sources, use statistical and computer models, recognize patterns in the data, identify opportunities or risks, and provide insights.

2 "How Will Artificial Intelligence Shape Mortgage Lending?", Mortgage Lender Sentiment Survey® special-topic study, October 2018, https://www.fanniemae.com/media/document/pdf/mlss-artificial-intelligence-100418pdf.

3 The seven ideas tested in the survey were AI-based compliance review, AI-based anomaly detection automation, AI-based mortgage loan offerings, AI-based property valuation, AI-based borrower prepay (move/refinance) assessment, AI-based borrower default risk assessment, and AI-based virtual assistant.