Mortgage Lenders Look to Leverage New Technologies to Gain Competitive Advantages

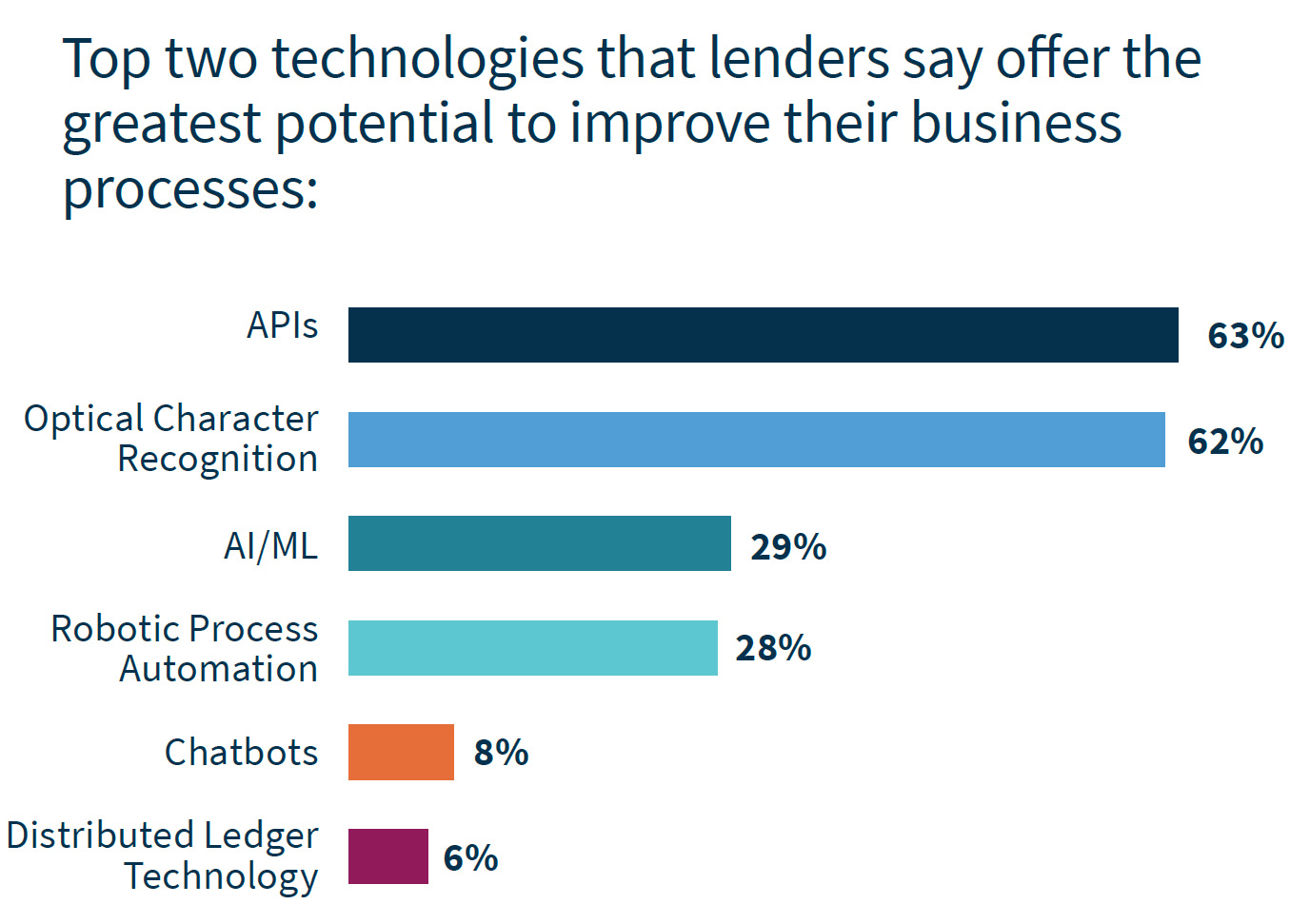

Mortgage lenders view Application Programming Interfaces (APIs) and Optical Character Recognition (OCR) as the top two technologies with the greatest potential to help improve or streamline processes, according to Fannie Mae’s Q1 2019 Mortgage Lender Sentiment Survey® (MLSS). Ease of technology integration was the most important criterion cited by lenders when deciding to adopt a third-party API.

Mortgage lenders view Application Programming Interfaces (APIs) and Optical Character Recognition (OCR) as the top two technologies with the greatest potential to help improve or streamline processes, according to Fannie Mae’s Q1 2019 Mortgage Lender Sentiment Survey® (MLSS). Ease of technology integration was the most important criterion cited by lenders when deciding to adopt a third-party API.

Businesses are increasingly leveraging digital technologies to reduce errors and costs, transact faster, and drive a richer and better customer experience. In the mortgage industry, many processes involve transmitting a large volume of data among a series of interconnected parties, including consumers, investors, and an array of service providers and stakeholders. Over the past few years, technological advancements such as artificial intelligence, APIs, and document digitization have gained traction, enabling digital transformation.

Through its quarterly MLSS, Fannie Mae’s Economic & Strategic Research Group recently surveyed senior mortgage executives to understand lenders’ views on these technologies, their criteria for adoption of a third-party API, and to gauge their interest in various API ideas. Nearly two-thirds of lenders selected APIs and OCR as the top two technologies with the greatest potential to help improve or streamline processes. Similarly, APIs and OCR were the technologies reported to be most likely to be rolled out more broadly by lenders in the next two years. Among the various API ideas shown in the study, an API to verify borrower qualification was the most appealing to lenders, followed by an API to obtain appraisers’ property appraisal value and comparables.

Ease of technology integration was cited by lenders as the most important criterion in deciding whether to adopt a third-party API. To ease integration, lenders indicated that government-sponsored enterprises (GSEs) can help set clear industry standards, provide guidance on best practices, and create user-friendly environments.

Competitive advantages conferred was the second most important criterion for lenders when deciding whether to adopt a third-party API. Lenders’ sentiment suggests that APIs may be a way for them to create a differentiated customer experience and develop competitive advantages.

Throughout the past several quarters, lenders have continuously reported the challenge of declining profit margin and the need to reduce costs and improve customer experience. APIs and OCR have the potential to help address these issues. However, previous research has shown that integration difficulties and investment costs are lenders’ top barriers. Identifying the benefits that justify technology investments may not be easy since the impacts are often multi-layered and include a mix of direct and indirect benefits. For example, the better customer experience achieved through APIs and OCR may lead to increased referrals or subsequent refinance or purchase loan business, which may save on costs and create brand preference.

APIs and OCR may also yield fewer mistakes, less rework, and an ability to translate fixed labor costs into variable costs, allowing a business to scale capacity up or down as the market expands or contracts. To properly justify technology investments, it is important to consider the indirect benefits, including time savings and customer goodwill, in addition to the more direct cost savings.

To learn more, read our Fannie Mae Mortgage Lender Sentiment Survey Special Topic Report, “APIs and Mortgage Lending"

Prabhakar Bhogaraju

VP, Digital Products

April 22, 2019

The author thanks Dana Schlafman, Natalie Hunt, Steve Deggendorf, and Li-Ning Huang for valuable contributions in the creation of this commentary and the design of the research. Of course, all errors and omissions remain the responsibility of the author.

Opinions, analyses, estimates, forecasts and other views reflected in this commentary should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Changes in the assumptions or the information underlying these views could produce materially different results.

1 Mortgage Lender Sentiment Survey, https://www.fanniemae.com/portal/research-insights/surveys/mortgage-lender-sentiment-survey.html

“Mortgage Lenders Shift Focus to Enhancing the Consumer Experience,” https://www.fanniemae.com/portal/research-insights/perspectives/mortgage-lenders-consumers-082317-duncan.html

”Lenders Look to Technology for Efficiency and to Improve the Consumer Experience,” https://www.fanniemae.com/portal/research-insights/perspectives/072616-jones.html

2 ”Integration: Key to Future Mortgage Technology Success,” https://www.fanniemae.com/portal/research-insights/perspectives/mortgage-technology-success-seidenstein-031317.html

”APIs Are Reshaping Business Strategy,” https://www.fanniemae.com/portal/research-insights/perspectives/apis-business-strategy-051817-stephan.html

“ Mortgage Data Initiatives: Setting the Stage for Digital Disruption,” https://www.fanniemae.com/portal/research-insights/perspectives/mortgage-data-initiatives-dorsey-012418.html