Servicers report biggest challenges implementing COVID-19 assistance programs

The COVID-19 pandemic has negatively impacted many industries, leaving many households with reduced income or unemployment. In response to this unprecedented challenge, mortgage lenders and servicers adapted rapidly to implement nationwide forbearance programs mandated under the CARES Act.1 Many homeowners experiencing a hardship can opt into a mortgage forbearance plan, which allows them to pause or lower their monthly payments for up to 12 months.2 In exiting forbearance, homeowners need to work with servicers on a plan to pay back the amount of reduced or paused payments.

In early September, we surveyed over 100 mortgage executives, via the Fannie Mae Mortgage Lender Sentiment Survey®, to better understand the biggest challenges servicers faced in offering assistance to impacted homeowners via forbearance programs and in communicating post-forbearance repayment plan options.3 In addition, we asked the executives who worked in mortgage servicing during the 2008 housing crisis to assess, separately, what aspects of servicing they found more challenging and less challenging compared to the 2008 crisis.

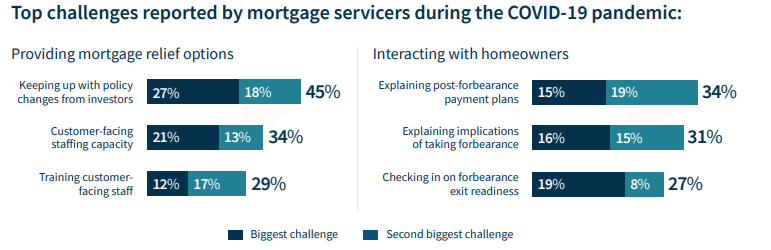

As the industry contended with a litany of policy updates and homeowner inquiries, the leading challenges identified by servicers were: 1) keeping up with policy changes from investors; 2) customer-facing staffing capacity; and 3) training the customer-facing staff to provide guidance to homeowners on mortgage relief and loss mitigation options. Technology and the process for homeowners to request assistance were much less of a concern. In addition, nearly 70 percent of mortgage servicers said their organization offers a website with mortgage relief information and payment assistance requests. Moreover, nearly 60 percent reported that their website helped reduce call center volume from homeowners inquiring about forbearance plans.

Click image above to view full size

When asked about the biggest challenges of interacting with homeowners, servicers most frequently cited: 1) explaining clearly to homeowners post-forbearance payment plans; 2) explaining clearly to homeowners the potential implications of taking a forbearance plan; and 3) periodically checking in with homeowners to see if they are ready to exit forbearance.

We also asked those survey respondents who worked in mortgage servicing during the 2008 housing crisis to compare their thoughts on the industry’s response then to its response to COVID-19-related challenges. A plurality of respondents found most aspects of servicing to have been less challenging this time – to include data and technology standards, the process by which homeowners request assistance, and more generally "helping homeowners overcome hardship and stay in their homes." The one area in which respondents said it was more challenging in 2020 regarded "keeping up with policy changes from investors."

In 2020, the servicing industry once again demonstrated its ability to adapt efficiently and timely in order to offer distressed homeowners much-needed mortgage relief. Since the 2008 housing crisis, common standards in servicing practices established the foundation of minimum expectations for borrower outreach. While those common standards played an important role in providing the industry a leg-up during this crisis, as evidenced by the survey, it was widely recognized among servicers that the challenges faced this year required a different response. And although the sudden surge of homeowner demand for mortgage assistance has receded, many are still in need of help accessing the mortgage relief and loss mitigation options available. The need to act timely remains a priority for servicers, as is the need to communicate clearly to borrowers. We believe more fully coordinated efforts across the industry to align policy and direction can help servicers respond to the current crisis and future crises with even greater effectiveness.

To learn more, read our Fannie Mae Mortgage Lender Sentiment Survey Special Topic Report, "COVID-19 Mortgage Servicing Challenges."

Caroline Patane

VP, Single-Family Counterparty Risk Oversight

January 12, 2021

The author thanks Ahmet Hacikura at Oliver Wyman, Li-Ning Huang, Doug Von Stein, Dan Miller, and Steve Deggendorf for valuable contributions in the design of the research creation and creation of this commentary. Of course, all errors and omissions remain the responsibility of the author.

Opinions, analyses, estimates, forecasts and other views of Fannie Mae’s Economic & Strategic Research (ESR) group or survey respondents reflected in this commentary should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR group represent the views of that group or survey respondents as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.

1 The federal government enacted the Coronavirus Aid, Relief, and Economic Security (CARES) Act on Mar. 27, 2020. The CARES Act includes provisions that provide assistance to some affected mortgage borrowers and renters. For details, please see https://www.consumerfinance.gov/coronavirus/cares-act-mortgage-forbearance-what-you-need-know/

https://www.fhfa.gov/Homeownersbuyer/MortgageAssistance/Pages/Coronavirus-Assistance-Information.aspx

2 The Mortgage Bankers Association's (MBA) Forbearance and Call Volume Survey revealed that, as of November 15 2020, the total number of loans in forbearance hovers around 5.48%. According to MBA's estimate, 2.7 million homeowners are in forbearance plans. https://www.mba.org/2020-press-releases/november/share-of-mortgage-loans-in-forbearance-increases-slightly-to-548-percent

3 Servicers in the current study refer to lending institutions who self-reported that they retain Mortgage Servicing Rights (MSRs) and service mortgage loans fully in-house or both in-house and via a sub-servicer, resulting in a total of 139 survey respondents, representing a total of 127 organizations.