Economic Pessimism Has Lenders Once Again Citing Cost-Cutting as Top Business Priority

Mortgage lenders cited "cost-cutting" as their most important business priority for the second year in a row, according to Fannie Mae's Mortgage Lender Sentiment Survey® (MLSS). Additionally, lender sentiment toward the U.S. economy remained extremely pessimistic, continuing a trend that began in the third quarter of 2021.

We recently surveyed over 200 senior mortgage executives via the MLSS, as we have since 2017, to better understand lenders' top business priorities for the year and how they may differ from prior years given changes in the market. This year, we added questions to gauge lenders' views about the U.S. economy and risk factors for the 2023 mortgage business.

Since the housing market boom of 2021, the mortgage industry has faced a number of challenges, including high home prices, multiple and significant interest rate hikes, elevated inflation, tight inventory of homes available for sale, and a slowdown of global economic growth. Not surprisingly, the consensus among mortgage executives seems to be that both purchase and refinance origination activity will continue to slow this year.

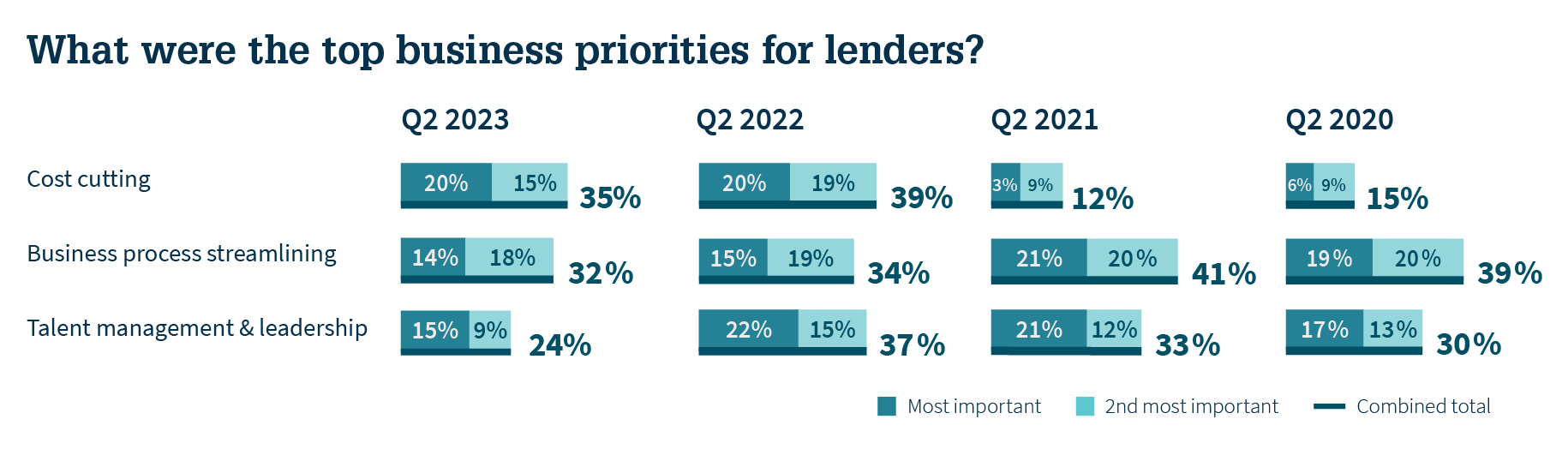

As noted above, for two consecutive years lenders have cited "cost-cutting" as their top business priority. Investment in "business process streamlining" has remained among the top three priorities since 2017. The importance of "talent management and leadership" fell after peaking in 2022 but remained in third place, tied with "consumer-facing technology." Notably "regulation and compliance" reached its highest share in six years (since 2018), suggesting lenders are facing increased regulatory pressures.

Click image above for larger view

A further examination of business priorities across the three institution types (depository institutions excluding credit unions, mortgage banks, and credit unions) yielded significant differences. While cost-cutting, business process streamlining, and new products/services are mortgage banks' top business priorities, talent management, regulation/compliance, and business process streamlining are depository institutions' top focus. In other words, mortgage bank priorities reflect higher cost and revenue pressures, whereas depository institution priorities reflect the challenges of meeting regulatory changes and recruiting talent to drive sales. Lenders also pointed out the importance of having the right leadership team to coach and motivate staff in today's tough business environment.

Overall, surveyed lenders once again exhibited a pessimistic outlook toward the economy. Seventy-three percent believe the U.S. economy is on the wrong track. Notably, the vast majority of lenders (93%) believe the U.S. economy is "very likely" or "somewhat likely" to enter a recession in the next two years (57% and 37%, respectively). Among them, many (68%) expect the recession to start in Q3 or Q4 of this year (24 percent saying Q3 2023 and 44 percent saying Q4 2023). A comparison between institution types shows that depository institutions are more pessimistic than mortgage banks: They are both more likely than mortgage banks to believe that the economy is on the wrong track (82% vs. 66%) and to believe that the U.S. economy will "very likely" enter a recession in the next two years (65% vs. 48%).

We also asked lenders about risk factors that could impact the mortgage business this year. Housing stock/supply and mortgage rate changes were cited by lenders as the biggest risk factors, followed by bank liquidity risk. Lenders were less concerned with cybersecurity, consumer access to credit, mortgage delinquencies, and the cost of goods and services.

Regarding the impact of the recent banking turmoil (including lack of consumer confidence in banks and fears of bank collapse) on lenders' business operations or mortgage production or servicing, the magnitude of expected impact appears to be limited. Only about a third of lenders surveyed indicated that that they expected their business to be impacted. Some lenders commented that, with deposit outflows and cost of funds increasing, liquidity has been reduced, particularly for loans on portfolio. Likely due to the lack of capital and liquidity, compared to the 2021 results, significantly more lenders in this quarter's survey reported credit tightening than easing.1

Overall, lenders' pessimistic sentiment toward the economy and their top risk concerns were reflected in this year's business priorities: cost-cutting and business process streamlining. Loan origination has yielded a loss since Q2 2022, and the average production cost per loan reached a new high in the first quarter at over $13,000 per loan.2 Comparing institution types, the survey results also suggest differentiated business priorities. Depository institutions are more focused on talent management and compliance, while mortgage banks are putting more effort toward cost-cutting and new products/services for additional revenue streams. As always, lenders are adapting their strategies, depending on their business model, to remain competitive – and in today's business environment, this is likely much more challenging than previous years.

To learn more, read the full research deck.

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae's Economic & Strategic Research (ESR) Group or survey respondents included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR Group or survey respondents represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.

1 Data points about lenders' credit standard practices are not available via the MLSS from Q2 2022 to Q1 2023. During that period, the MLSS did not include questions about credit standards.