Opportunities to Enhance Pre-Purchase Homeownership Education

Pre-purchase homeownership education should help consumers make informed housing decisions; for example, whether to rent or own, how much home is affordable, what mortgage terms are most important, and what are the total costs of homeownership. Ideally, better-informed consumer decision-making would result in better outcomes, including more sustainable homeownership and reduced mortgage defaults. Research results about the outcomes and effectiveness of pre-purchase homeownership education and counseling, however, vary considerably1, prompting us to research current pre-purchase homeownership education practices and experience within the mortgage industry.

Pre-purchase homeownership education should help consumers make informed housing decisions; for example, whether to rent or own, how much home is affordable, what mortgage terms are most important, and what are the total costs of homeownership. Ideally, better-informed consumer decision-making would result in better outcomes, including more sustainable homeownership and reduced mortgage defaults. Research results about the outcomes and effectiveness of pre-purchase homeownership education and counseling, however, vary considerably1, prompting us to research current pre-purchase homeownership education practices and experience within the mortgage industry.

In November and December 2016, Fannie Mae’s Economic and Strategic Research team conducted interviews2 with lower-income first-time homebuyers, loan officers, and real estate agents who have experience with pre-purchase homeownership education3. We wanted to understand each group’s motivations and identify the gaps and opportunities to optimize homeownership education participation. The objective of this initial research with a small group of participants was to develop insights to inform broader survey research that can help identify opportunities at a larger scale.

All three groups interviewed agreed that pre-purchase homeownership education empowers consumers with knowledge and confidence to be "financially and emotionally prepared" for homeownership. Six factors appear to affect the use and benefits of homeownership education:

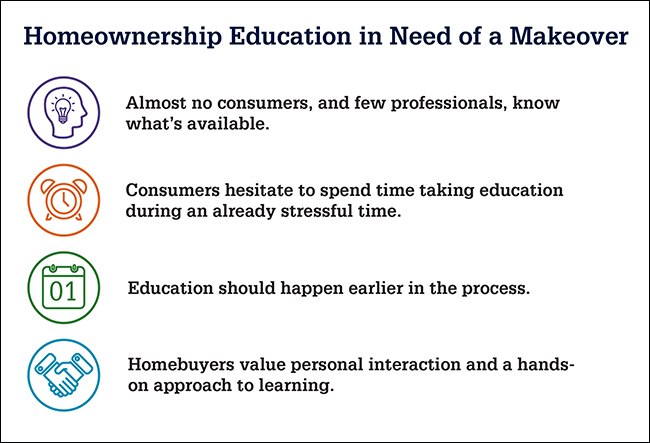

- Awareness: Respondents indicated they had little or no awareness of pre-purchase homeownership education – except for mandatory programs required for specific loans. In current practice, participation in homeownership education is primarily driven by referrals made by loan officers in order for borrowers to qualify for specific loan products or benefits, such as down payment assistance, and those referrals usually come late in the home-buying process.

- Motivational Barriers: Buying and financing a home can be stressful, and consumers are not eager to take homeownership education during an already stressful time. Loan officers often see education as just one more thing on an already long closing checklist. Real estate agents focus on finding the home and consider homeownership education as beyond the scope of their services.

- Content: Both consumers and professionals agree that the content of the homeownership education they saw was comprehensive and helpful. It covered the entire process from creditworthiness to loan application and home maintenance.

- Channel: Lower-income homebuyers had a strong preference for in-person learning rather than online because they value personal interaction, customization, and a hands-on approach to learning. A few consumers noted that online learning offers convenience and flexibility, but say it needs to be highly interactive.

- Incentives: Consumers and professionals agreed that incentives are important for motivating participation. Even small offers, such as $100 toward closing, appraisal, or inspection, would make a difference.

- Timing: Poor timing was a key complaint. Homeownership education usually happens late in the process, two to three weeks before closing. Both consumers and professionals suggest that it could be a requirement for pre-qualification.

This initial research highlights the need for greater awareness of homeownership education offerings. It showcases the need for more effective collaboration across the industry to support a more timely and effective educational experience, one that empowers the consumer without adding complexity or delay to the home-buying process. The research also highlights the competing demands for a more “personalized” educational experience versus the flexibility and convenience offered by online options. It appears that providing incentives to encourage voluntary participation and positioning homeownership education as a consumer empowerment tool as opposed to a loan requirement would increase use.

The housing counseling industry is continuing to innovate to meet today’s consumer learning needs. Our research indicates that cross-industry collaboration across public policy, lending, technology, education, and marketing outreach will be critical in driving further success in helping consumers. We are preparing to conduct further research to gain deeper understanding of the observations revealed in this qualitative research and test hypotheses about opportunities to further enhance homeownership education and will continue to share the results of our research.

To learn more, read Fannie Mae’s Pre-Purchase Homeownership Education Qualitative Research Report.

Joe Weisbord

Director, Credit and Housing Access

The author thanks Anne McCulloch, Bob Kantor, Elizabeth Kamins, Steve Deggendorf, Anne McGrath, and Li-Ning Huang for valuable contributions in the creation of this commentary and the design of the research. Of course, all errors and omissions remain the responsibility of the author.

Opinions, analyses, estimates, forecasts and other views reflected in this commentary should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Changes in the assumptions or the information underlying these views could produce materially different results.

1 Examples include: Scott, B. (2015). The Influence of Homebuyer Education on Default and Foreclosure Risk: A Natural Experiment, Journal of Policy Analysis and Management, 35(1), 145-172. Smith, M. M., Hochberg, D., & Greene, W. H. (2014). The Effectiveness of Pre-Purchase Homeownership Counseling and Financial Management Skills. Federal Reserve Bank of Philadelphia Working Paper. Agarwal, S., Amromin, G., Ben-David, I., Chomsisengphet, S., & Evanoff, D. (2014). The Effectiveness of Mandatory Mortgage Counseling: Can One Dissuade Borrowers from Choosing Risky Mortgages? (No. w19920). National Bureau of Economic Research.

2 Qualitative methodologies are used to discover insights and directions. These findings are exploratory in nature and are not intended to be projectable to a larger population.

3 The research was conducted in four markets: Dallas, TX, Memphis, TN, Cleveland OH, and Knoxville, TN. One-hour individual in-depth interviews were conducted among 54 lower-income first-time homebuyers and eight two-hour mini-focus-groups were conducted among real estate agents (four groups) and loan officers (4 groups) who have experience working with lower-income first-time homebuyers and pre-purchase homeownership education/counseling programs. For consumers, household income had to be lower than $65K, $45K, $55K and $45K, respectively, for Dallas, Memphis, Cleveland, and Knoxville. Among the 54 consumers interviewed, 42 of them have purchased homes in the past six months and 12 of them were renters who had obtained loan pre-qualification and planned to purchase their first home in the next six months. For more research methodology details, please see the research report.