The Coming Exodus of Older Homeowners

Baby Boomers, the massive generation born between 1946 and 1964, and their elders have an enormous housing market footprint. Collectively, these older adults inhabit 46 million owner-occupied homes worth an estimated $13.5 trillion.

Baby Boomers, the massive generation born between 1946 and 1964, and their elders have an enormous housing market footprint. Collectively, these older adults inhabit 46 million owner-occupied homes worth an estimated $13.5 trillion.

Departures of these older adults from the homeownership market (leaving for rentals, senior care facilities, or by reason of death) will accelerate in coming years as Baby Boomers continue to age. With the oldest Boomers now in their early 70s, the beginning of a mass homeownership exodus looms on the horizon, fueling fears of a “generational housing bubble” in which homeownership demand from younger generations is insufficient to fill the void left by multitudes of departing older owners.

But how can we predict when this wave of departures will begin and forecast the pace at which it will unfold over coming decades? A new Housing Insights from the University of Southern California and Fannie Mae’s Economic & Strategic Research Group answers this question by analyzing attrition of past generations of older homeowners and using the findings to project the future cadence of aging-related homeownership exits.

Steady Trends of the Past Provide a Foundation for Predicting the Future

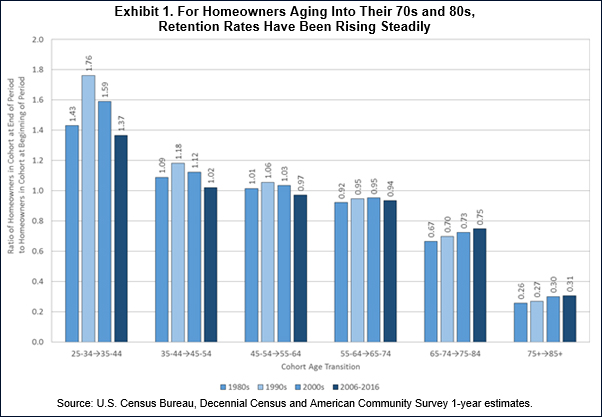

To develop a basis for our projections of older homeowner exits, we first analyze historical homeownership retention rates for cohorts of owner-occupants as they advanced through their elderly years over the last few decades. The cohort homeownership retention rate is the ratio of the number of homeowners in a birth cohort at the end of a period to the number of owners in the same cohort at the beginning of the period. A retention rate greater than 1.0 indicates that the number of homeowners in a cohort increased as it aged; a value less than 1.0 indicates that the number of homeowners declined with aging.

Exhibit 1 shows cohort homeownership retention rates for 10-year-wide birth cohorts as they aged through various 10-year periods since 1980. Two features of Exhibit 1 stand out. First, looking from left to right on the chart, we see that the number of homeowners in a cohort increases through its mid-50s, is relatively stable as the cohort ages through its late 50s through early 70s, and then begins to drop rapidly as the cohort advances into its late 70s and 80s. For cohorts aging from 65-74 to 75-84 (second-to-last cluster of bars at the right of Exhibit 1), only between two-thirds and three-quarters of homeowners are retained over the course of ten years, and for cohorts aging from 75+ to 85+ (last cluster of bars at the right of Exhibit 1), merely three-in-ten homeowners remain after ten years.

Exhibit 1 also reveals that cohort homeownership retention rates were either stable or rising steadily across recent decades for the oldest cohort age transitions. Retention rates for cohorts aging from 55-64 to 65-74 ranged only from 0.92 to 0.95 across recent decades. Retention rates for cohorts passing through the oldest age groups have increased steadily in recent decades regardless of the economic and housing climate, from 0.67 to 0.75 for those aging between 65-74 and 75-84, and from 0.26 to 0.31 for those aging to 85 and older.

Aging Baby Boomers Will Trigger a Growing Exodus of Older Homeowners

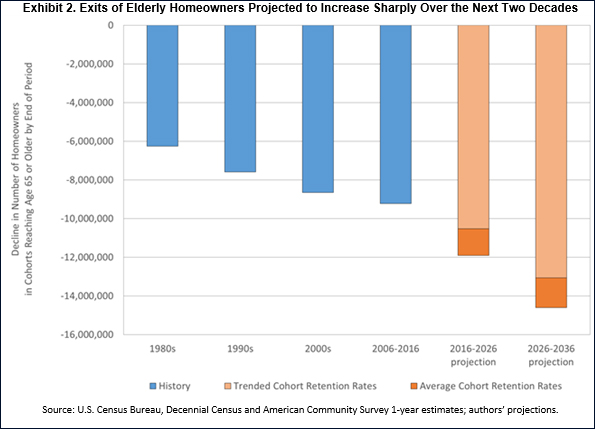

The stability of recent trends in cohort homeownership retention rates for older adults provides a solid foundation for predicting exits of older homeowners in coming decades. We use the 10-year cohort homeownership retention rates observed since 1980 to create two projection scenarios for the number of older adults exiting homeownership over the coming two decades. In the first scenario, we assume that retention rates for homeowners aging into the 75-84 and 85+ categories will continue to rise gradually at the same average pace as observed between 1980 and 2010. In the second scenario, we hold retention rates for homeowners aging into the 75-84 and 85+ categories constant at the average value observed across all four historical decades shown in Exhibit 1. Because retention rates for those aging from 55-64 to 65-74 have been relatively constant across recent decades, we use average historical retention rates for this age transition in both projection scenarios. We apply the homeowner retention rates for each scenario to the distribution of homeowners by age in 2016 to produce two alternative projections of the number of older adults exiting homeownership over the next two decades.

Regardless of the scenario, the projections indicate substantial increases in the number of older adults exiting homeownership over the next two decades (see Exhibit 2). Between 2006 and 2016, the cohorts that reached age 65 or older by the latter year lost 9.2 million homeowners. Between 2016 and 2026, cohorts passing into the same age range are projected to lose 10.5 million to 11.9 million homeowners, depending on the projection scenario. Looking further out to 2026-2036, cohorts aging into the 65+ age range are projected to shrink by between 13.1 million and 14.6 million homeowners, a loss at least 42 percent greater than registered during the most recent decade.

Given that homeownership retention rates for older adults have been stable or rising, why do losses of older homeowners increase by so much in our projections? The reason is that the number of older homeowners “at risk” of attrition due to advancing age will balloon as the large Baby Boomer generation moves full-force into the 65-and-older age group where homeowner retention rates drop substantially. In 2006, when the oldest Baby Boomers were only age 60, the 65-74 age group contained 9.3 million homeowners. By 2016, when the oldest Boomers had reached age 70, the number of homeowners age 65-74 had swollen to 13.6 million, thereby putting a substantially larger number of older owner-occupants at risk of exiting homeownership over the next ten years. By 2026, when the youngest Boomers will be age 62 and the oldest age 80, the number of owner-occupants age 65-74 is projected to jump again to about 16.4 million, putting an even greater number of older owners on the precipice of aging-related homeownership attrition.

Although aging Baby Boomers will trigger the coming exodus of older homeowners, government and industry efforts to mitigate possible adverse market impacts will likely need to span the generations. Some efforts might seek to extend the period over which Boomers exit homeownership, as by providing home improvement financing options or community-based social support services that assist those who wish to age in place. Other efforts might focus on growing homeownership demand among Millennials, as by continuing recent efforts to provide sustainable home purchase financing options for first-time buyers, thereby helping the younger generation to build housing equity and eventually purchase homes vacated by aging Boomers. Because immigrants contribute substantially to homeownership demand growth, immigration policy will also likely play a role in determining the adequacy of replacement demand for the homes vacated by Boomers.

As these examples illustrate, efforts to ease the market impacts of the coming wave of older homeowner departures could take many forms. However, fostering a smooth intergenerational handoff of housing assets will likely require approaches that span the age spectrum and that seek to forge a bond of mutual housing market interests between old and young.

Dowell Myers

University of Southern California

Patrick Simmons

Fannie Mae

The authors thank Mark Palim and Orawin Velz for valuable comments in the creation of this edition of Housing Insights. Of course, all errors and omissions remain the responsibility of the authors.

Opinions, analyses, estimates, forecasts and other views of Fannie Mae's Economic & Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.