Recent homebuyers are flocking to mobile mortgage resources and may encourage new mortgage market entrants

Consumers’ mobile experiences with leaders such as Amazon are reshaping their expectations in all aspects of their lives, including for their financial and mortgage activities. To better understand the impact of mobile technology on the consumer mortgage experience, in Q1 2016 we surveyed approximately 1,200 low- and moderate-income (below or at the area median income) homebuyers about their recent mortgage shopping and origination experience. The survey sample was taken from purchase mortgages originated in 2015 and acquired by Fannie Mae.

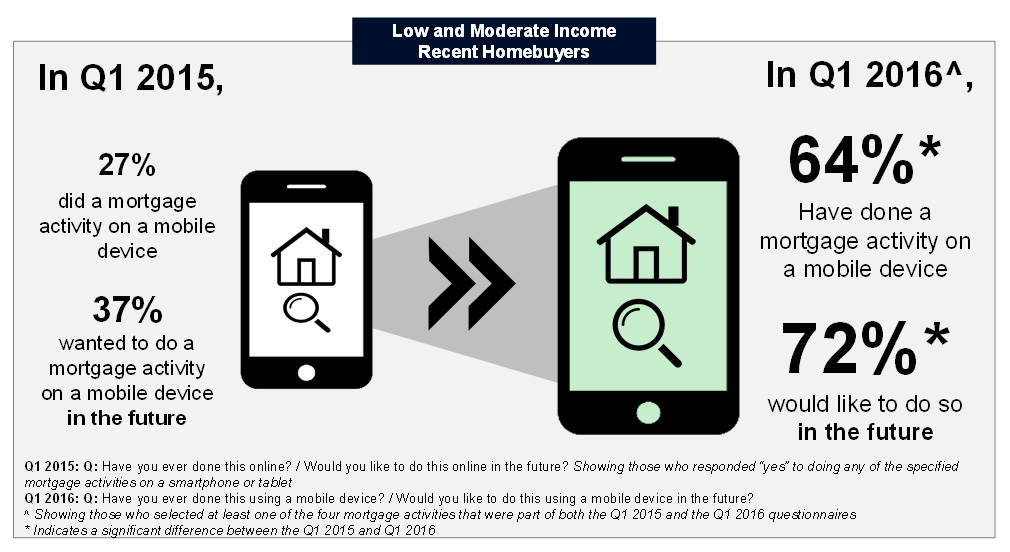

Interestingly, we found a major increase (Figure 1) in mobile mortgage current usage and future interest – both figures approximately doubled in the last year. This is a startlingly large increase reflecting the pervasive and growing use of mobile technology among consumers at all income levels. Although this research focused on low- and moderate-income homebuyers, our prior research suggests the results would be even larger for mobile usage and interest among higher-income consumers. Some lenders such as Quicken and Sofi have already begun to reflect the mobile demands of consumers; yet, the growing use of and interest in mobile tools in the mortgage process should be a call to all mortgage lenders to focus their attention on substantially enhancing their consumer mobile experience.

Figure 1. Mobile mortgage usage and demand have approximately doubled in the last year among low- and moderate-income recent homebuyers from Fannie Mae’s book of business

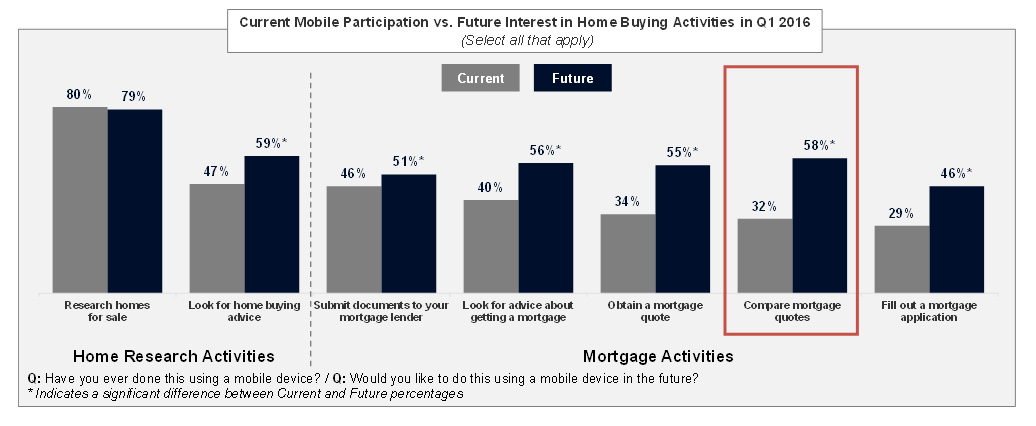

We found significant interest in using mobile tools for a variety of home buying activities across the mortgage process (Figure 2). Current usage among recent low- and moderate-income homebuyers is higher in home research activities than in mortgage activities, but that may be because only a few lenders currently offer an end-to-end mobile experience. Using a mobile device to research homes for sale seems to be well addressed, with both current mobile usage and future interest about equal. There is significant opportunity to meet consumer demand beyond this. Future interest in mobile usage for mortgage activities is much higher than current usage. Mobile usage and interest for home buying activities is most prevalent among younger, college-educated, and first-time homebuyers.

Figure 2. Current usage and future interest for mobile activities are evident across home research and mortgage activities

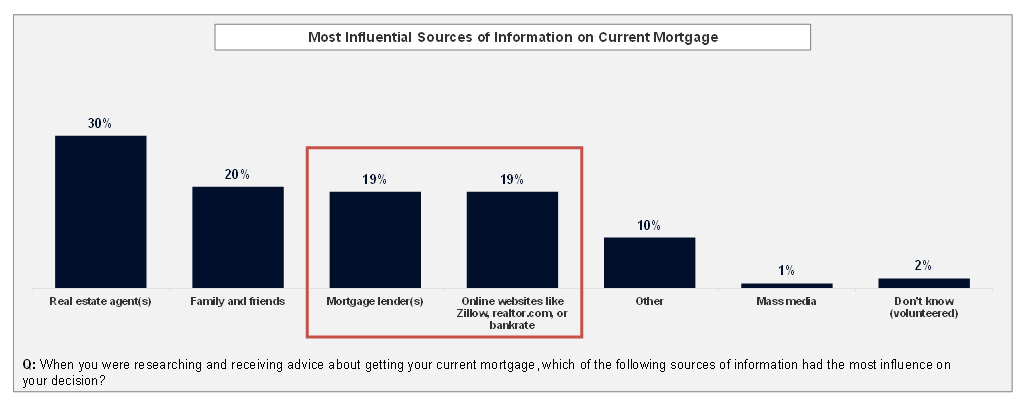

Low- and moderate-income recent homebuyers told us that online sources are as influential as lenders (Figure 3) in their mortgage decision. Also, about half of low- and moderate-income recent homebuyers are interacting mainly with their lender using a mix of online, in-person, and phone channels when getting a mortgage, versus the other half who use mostly in-person and phone channels. Our National Housing Survey® research completed last year indicated even higher potential interest in using online and mobile tools to obtain a mortgage among younger and higher-income consumers, who are less likely to prefer in-person contact. In addition, our Mortgage Lender Sentiment Survey® research indicated that many mortgage lenders have started to respond to interest in mobile resources by developing mobile apps, and with expectations suggesting that half of lenders would offer a mobile app by the third quarter of 2016.

Figure 3. Mortgage lenders and online websites have the same level of influence on low- and moderate-income recent homebuyers as sources of mortgage advice

Though some lenders have begun building out the mobile experience for consumers, all lenders should evolve their online and mobile capabilities to address the rapidly changing consumer demand as well as the potential for competitive shifts. The potential for the competitive repositioning in the broader mortgage market value chain is high, maybe much higher than in many years, as next-generation technologies and providers focus on offering exciting mobile opportunities to improve the consumer experience through digitization and by removing inefficient manual processes. Newer mobile technologies offer existing players new process options to consider, and also may entice new players to enter the mortgage business – players who could reinvent current roles and create influential new roles, such as providing “just-in-time” advice and comparison shopping. Early in the mortgage shopping process, before consumers connect with a lender, the impact of new entrants may be both powerful in creating new loyalties and also disruptive to traditional relationships, thus potentially weakening the role that lenders play with consumers.

Steve Deggendorf

Director, Market Insights Research

December 5, 2016

Opinions, analyses, estimates, forecasts and other views of Fannie Mae's Economic & Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.