Many Starter Homes Have Shifted from Owner-Occupancy to Rentals

Subdued first-time home buying has slowed the housing recovery. Both demand- and supply-side factors have suppressed purchases by would-be first-time buyers. But as the labor market has continued to heal and as young-adult incomes have begun to recover, much attention has focused on supply-side constraints. Tight mortgage credit is often cited as an obstacle, but in recent months attention has shifted to a low inventory of for-sale starter homes as an impediment to the return of the first-time buyer.

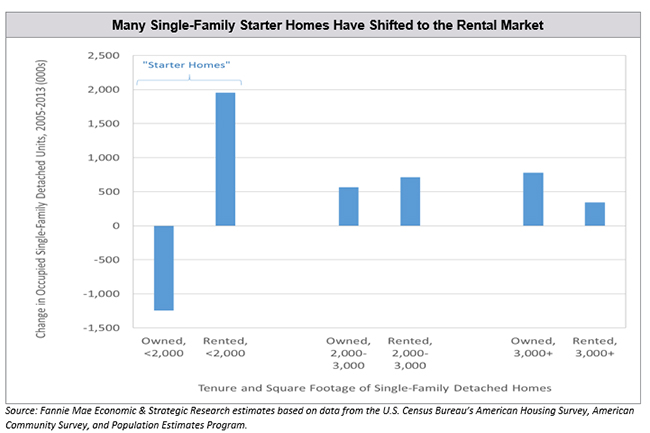

One factor that has contributed to the shortage of starter homes is the shift of single-family houses from owner-occupancy to rentals during the housing bust and recovery. To explore this factor, a new Housing Insights from Fannie Mae’s Economic & Strategic Research group analyzes net changes since the onset of the housing downturn in the number of starter homes – here defined as single-family detached units with less than 2,000 square feet of floor area – that are owner- and renter-occupied.

Our analysis revealed that the stock of owner-occupied starter homes declined by more than 1 million units between 2005 (roughly the peak of the housing boom) and 2013 (the most recent year for which data are available), whereas the inventory of renter-occupied starter homes rose by approximately 2 million units during the same period (see chart). Starter homes accounted for two-thirds of the growth in all single-family detached rentals during the period.

While many starter homes were shifting to the rental market, new construction was adding fewer entry-level houses to backfill for the lost units. In 2005, home builders completed about 650,000 single-family detached and attached homes of less than 2,000 square feet. By 2011, starter-home completions had plummeted to less than 200,000 units per year, and have since shown little sign of rebounding.

The shift of the starter home inventory toward the rental market reflects, at least in part, a much-needed market adjustment in response to imbalances created by the credit bubble and homeownership boom of the early 2000s. The shift helped to remove bloated inventories of vacant and foreclosed single-family homes from the market, while also helping to meet exploding demand for rentals created by the economic downturn, foreclosure crisis, and coming of age of the large Millennial generation.

Future market adjustments might shift some of the single-family rental inventory back to owner-occupancy. Indeed, some institutional investors in the single-family rental space have launched initiatives that make rental units available for purchase by their tenants. However, given the substantial obstacles to homeownership that many first-time buyers face, consideration might be given to additional private and public initiatives for expanding the starter home supply, such as expanding rent-to-own financing options and reviewing development regulations, impact fees, and construction approval delays that might be hindering the building of entry-level homes.

Patrick Simmons

Director, Strategic Planning

Economic & Strategic Research Group

October 18, 2016

The author thanks Orawin Velz and Mark Palim for valuable comments in the creation of this FM Commentary. Of course, all errors and omissions remain the responsibility of the author.

Opinions, analyses, estimates, forecasts and other views of Fannie Mae's Economic & Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.