Lenders Expect Benefits from the GSE 97% LTV Products and the FHA Mortgage Insurance Premium Reduction

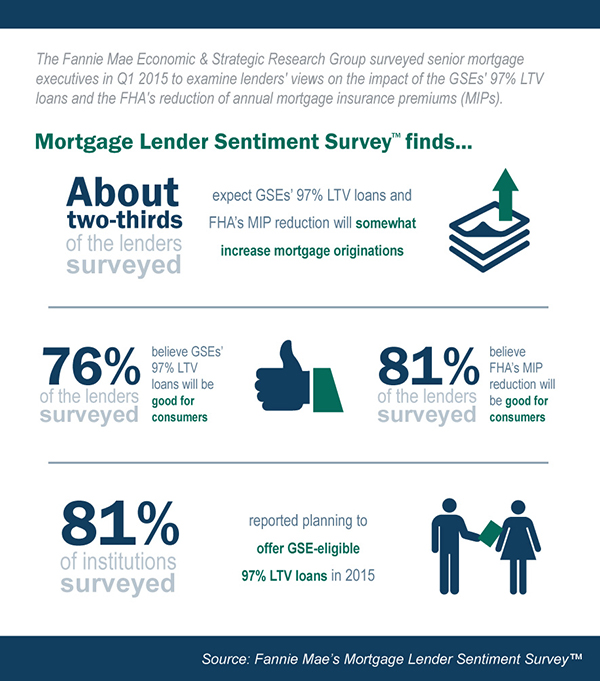

Late last year, Fannie Mae and Freddie Mac announced an expansion of the availability of certain loans with a maximum loan-to-value (LTV) ratio of 97%. In addition, the Federal Housing Administration (FHA) beginning on January 26, 2015 reduced annual mortgage insurance premiums (MIPs) by 0.5% on new loans. These initiatives endeavor to expand access to mortgage credit and make monthly mortgages more affordable to qualified and creditworthy borrowers. Fannie Mae’s Economic & Strategic Research Group surveyed senior mortgage executives in February through its quarterly Mortgage Lender Sentiment Survey™ (MLSS) to examine lenders' views about the expected impact of these two initiatives.

Lenders Say Consumers and Lenders Should Benefit

Lenders told us the top two causes of mortgage volume declines in 2014 were tighter credit underwriting standards and weak consumer demand. In prior research from our National Housing Survey™ (NHS), young renters said that gathering a down payment and affording the monthly mortgage payment are two of the top barriers to obtaining a mortgage1. The GSE and FHA initiatives seek to address these lender and consumer concerns by expanding credit access through the GSEs’ lower down payment requirements (helping those who can’t afford a larger down payment) and from the FHA’s lower mortgage insurance premiums (helping those who need more affordable monthly mortgage payments). Consistent with the intent of these initiatives, about two out of three lenders surveyed expect that the GSEs’ 97% LTV products and the FHA’s MIP reduction will somewhat increase mortgage originations, while one-third of lenders surveyed do not expect those offerings to impact mortgage originations.

Also, the majority of lenders surveyed think that the GSEs’ 97% LTV products and the FHA’s MIP reduction will be good for consumers and lenders.

Eighty-one percent of institutions surveyed reported planning to offer GSE-eligible 97% LTV loans sometime this year, though the expected impact on their own firm’s origination volume is more muted than their expectations for the impact on the overall mortgage market in the future. Forty-four percent of those planning to offer GSE-eligible 97% LTV loans expect them to somewhat increase their firm’s origination volume. Fifty-four percent expect their firm’s origination volume to remain about the same.

Mixed Views of Counseling Benefits

Since some consumers who take on GSE 97% LTV loans are required to take homeownership counseling programs, this analysis also examines lenders’ views on these programs. The vast majority (91%) of lenders reported offering or referring consumers to homeownership education and counseling programs. The top reason that firms reported offering or referring consumers to homeownership education and counseling programs is to help borrowers better manage their finances.

Lenders’ views on the value of homeownership education and counseling programs for their business are mixed: 33% say they have value, 36% say they do not, and 31% are neutral. Mid-sized and smaller lenders are more likely than larger lenders to say there is less value in homeownership education and counseling programs. Given the mixed perceptions of lenders about the benefits from pre-purchase counseling and the academic research suggesting that it is unclear whether counseling delivers a meaningful improvement in outcomes2, there appears to be an opportunity to investigate whether it is possible to enhance counseling strategies to generate, improve, and more clearly demonstrate consumer, lender, and investor benefits.

To learn more, read our Fannie Mae Q1 2015 Mortgage Lender Sentiment Survey Topic Analysis.

1 Please see the special topic analysis “What Younger Renters Want and the Financial Constraints They See”

https://www.fanniemae.com/portal/research-insights/perspectives/050514-shahdad.html.

2 Collins, J. Michael and O’Rourke, Collin M. “Financial Education and Counseling – Still Holding Promise.” The Journal of Consumer Affairs Vol. 44, No. 3 2010.

Smith, Marvin M.; Hochberg, Daniel; and Greene, William H. “The Effectiveness of Pre-Purchase Homeownership Counseling and Financial Management Skills.” Federal Reserve Bank of Philadelphia. April 2014.

Steve Deggendorf

Director, Business Strategy

Economic & Strategic Research Group

April 23, 2015

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae's Economic & Strategic Research (ESR) group or survey respondents included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR group bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR group represent the views of that group or survey respondents as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.