Lenders Are Trying to Grow Their Businesses, but Worry about Compliance and Competition

Last year turned out to be a positive one for the mortgage market. Home sales and housing starts registered their strongest pace of growth since before the recession. Combined with solid home price appreciation, this pushed total purchase mortgage originations higher than in 2014. On the refinance side, lenders benefitted from lower average mortgage rates, keeping volumes higher than originally projected.

However, lenders face a tougher operating environment in 2016. We believe mortgage rates will edge up slightly over the course of the year as the Federal Reserve begins to normalize monetary policy by increasing the Fed Funds target. While we believe that trends in home sales, home prices, and homebuilding activity will continue to be positive this year, rising interest rates will slow refinance originations by more than the expected increase in purchase originations, thereby shrinking the total pie for mortgage lenders. We expect total single-family mortgage originations to drop about 11 percent this year to $1.51 trillion, thereby elevating lenders' competitive pressures.

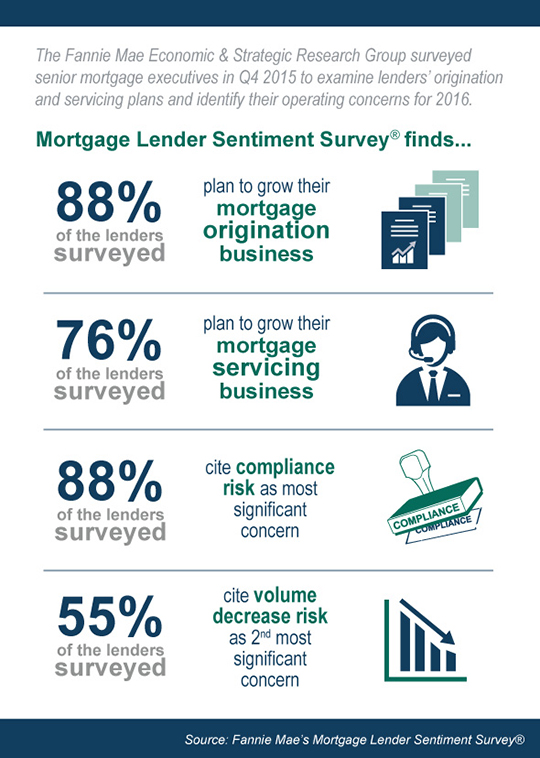

Against this backdrop, Fannie Mae's Economic & Strategic Research Group surveyed senior mortgage executives in November 2015 through its quarterly Mortgage Lender Sentiment Survey® to examine lenders' plans for their origination and servicing businesses in 2016 and identify their concerns.

The survey results suggest that lenders share an outlook similar to ours. However, despite their desire to grow or maintain their origination business in 2016, lenders reported that they are worried about compliance risk and volume decrease risk. When asked to identify the top three areas of concern for their business in 2016, 88 percent of lenders cite compliance risk and 55 percent of lenders cite volume decrease risk.

To remain competitive in the marketplace, lenders cite "increasing the number of retail branches/loan officers" and "expanding marketing outreach" as the top two strategies they plan to use. Additionally, compared with the prior year, lenders this time reported a heavier emphasis on attracting new borrower segments and expanding Direct-to-Consumer online lending capabilities while fewer plan to offer new mortgage products.

In our view, the shift in focus to a purchase mortgage market puts a priority on shoring up builder and real estate relationships. The expected volume decline, if it occurs, will likely bring some downsizing and merger and acquisition activity. However, layoffs and rehiring are expensive, so there is usually a several-month lag between significant volume turns and staff reductions. Additionally, rates have fallen since the Fed raised rates in December, so there is no sign of a rate rise yet.

Specific survey findings include:

- 88 percent of the lenders surveyed reported that they are looking to grow their mortgage origination business, compared with only 12 percent reporting to maintain and no lenders reporting to downsize or exit the origination business.

- "Increasing the number of retail branches/loan officers" and "expanding marketing outreach" are the top two strategies/tactics reported by lenders to grow their origination business. Compared with the previous year, lenders are planning to put a heavier emphasis on attracting new borrower segments and expanding Direct-to-Consumer online lending capabilities, while fewer plan to offer new mortgage products.

- 76 percent of the lenders surveyed reported plans to grow their mortgage servicing business, compared with only 22 percent expecting to maintain and 2 percent expecting to downsize. Depository institutions and smaller lenders are more likely than mortgage banks and larger institutions to cite "cross-sell opportunities to other financial products" as a key reason, while mortgage banks and larger institutions are more interested in hedging against declining origination volumes.

- Compliance risk continues to be lenders' most significant concern. The vast majority of lenders (89 percent) say their concerns with compliance risk have increased since the previous year and a similar number (88 percent) say compliance risk will be a key area of focus in 2016.

- Concern over volume decrease risk has fallen compared with one year ago. However, about half of lenders still expect it to be an area of focus in 2016.

To learn more, read our Fannie Mae Q4 2015 Mortgage Lender Sentiment Survey Topic Analysis.

Doug Duncan

Chief Economist and Senior Vice President

Economic and Strategic Research

February 24, 2016

The author thanks Tom Seidenstein, Steve Deggendorf, Li-Ning Huang, and Orawin Velz for valuable comments in the creation of this commentary and the design of the topic analysis questions. Of course, all errors and omissions remain the responsibility of the author.

Opinions, analyses, estimates, forecasts and other views of Fannie Mae's Economic & Strategic Research (ESR) Group or of survey respondents reflected in this commentary should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR group bases its opinions, analyses, estimates, forecasts and other views on information it considers reliable, it does not guarantee that the information provided in this commentary is accurate, current or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts and other views published by the ESR group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.