Survey Shows Lenders Are Looking to Grow Their Origination and Servicing Businesses

Li-Ning Huang

Senior Manager, Economic & Strategic Research

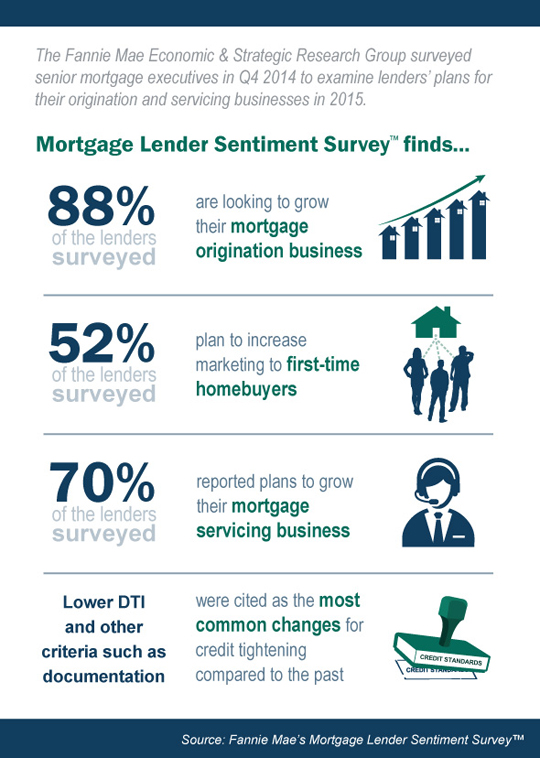

During 2014, regulatory changes, the shift from a refinance to a purchase market, and the modest pace of housing growth posed challenges for the mortgage industry. Fannie Mae’s Economic and Strategic Research Group surveyed senior mortgage executives in November 2014 through its quarterly Mortgage Lender Sentiment Survey™ to examine lenders’ plans for their origination and servicing businesses in 2015.

Survey results show that, despite lenders’ concerns about compliance and weak consumer demand,1 the vast majority of lenders have a positive outlook. Most lenders surveyed said that they are looking to either grow or maintain their origination and servicing businesses. No lenders reported plans to downsize or exit their origination business and only four percent of lenders reported plans to downsize their servicing business. In particular, consistent with industry trends observed, lenders reported plans to increase marketing to first-time homebuyers and move-up homebuyers as part of their 2015 origination strategy. In addition, larger lenders have stated a focus on affluent consumers. Mid-sized and smaller lenders indicated that they are more likely to focus on lower-than-median income consumers.

In terms of credit standards, lower Debt-to-Income ratio (DTI) and other stricter criteria such as documentation (but not Loan-to-Home-Value ratio or FICO) are the most common changes cited by lenders who reported tighter credit standards compared with the past, reflecting the impact of the Ability-to-Repay/Qualified Mortgage rule which took effect in January 2014. Specific survey findings include:

- 88 percent of the lenders surveyed reported that they are looking to grow their mortgage origination business, compared with only 12 percent reporting to maintain and no lenders reporting to downsize or exit the origination business. “Increasing the number of retail branches/loan officers” and “expanding marketing outreach” are the top two strategies/tactics reported by lenders to grow their origination business.

- For 2015, 52 percent of lenders say they plan to increase their marketing to first-time homebuyers and 42 percent of lenders plan to increase marketing to move-up homebuyers. In addition, larger institutions are more likely to increase their marketing to affluent consumers while mid-sized and smaller lenders are more likely to increase their marketing to lower-than-median income consumers.

- 70 percent of the lenders surveyed reported plans to grow their mortgage servicing business, compared with only 24 percent reporting a plan to maintain and 4 percent reporting to downsize. Lenders across the board cite “potential revenue/profit” as the primary reason for growing their servicing business. Larger and mid-sized lenders cite “hedging against declining origination volume” as the second most important reason. Smaller lenders cite “cross-sell opportunities” as the second most important reason for growing their servicing business.

- Though larger lenders were more likely to report credit easing than tightening,2 overall when comparing credit standards with three years ago, 44 percent of lenders reported tighter standards, in particular among depository institutions (49 percent). “Lower DTI” and “Stricter other criteria such as documentation” are the most common changes cited by lenders (61 percent and 84 percent, respectively).

To learn more, read our Fannie Mae Q4 2014 Mortgage Lender Sentiment Survey Topic Analysis.

Li-Ning Huang, Ph.D.

Senior Manager, Business Strategy

Economic & Strategic Research Group

January 26, 2015

1 Please see the special topic analysis “ Lenders’ Assessment of Complying with Increased Regulations” at https://www.fanniemae.com/portal/research-insights/surveys/mortgage-lender-survey-101514.html and the Q4 2014 Mortgage Lender Sentiment Survey Report at https://www.fanniemae.com/resources/file/research/mlss/pdf/mlss-findings-q42014.pdf.

2 Detailed quarterly tracking results are available at https://www.fanniemae.com/portal/research-insights/surveys/mortgage-lender-sentiment-survey.html.

The author thanks Doug Duncan, Renee Schultz, Tom Seidenstein, Gerry Flood, Steve Deggendorf, Richard Koss, Steve Solomon, and David Keil for valuable comments in the creation of this commentary and the design of the topic analysis questions. Of course, all errors and omissions remain the responsibility of the author.

Opinions, analyses, estimates, forecasts and other views of Fannie Mae's Economic & Strategic Research (ESR) Group or of survey respondents reflected in this commentary should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR group bases its opinions, analyses, estimates, forecasts and other views on information it considers reliable, it does not guarantee that the information provided in this commentary is accurate, current or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts and other views published by the ESR group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.

The views expressed in this article reflect the personal views of the author, and do not necessarily reflect the views or policies of any other person, including Fannie Mae or its Conservator. Any figures or estimates included in an article are solely the responsibility of the author.