Credit Risk Transfer

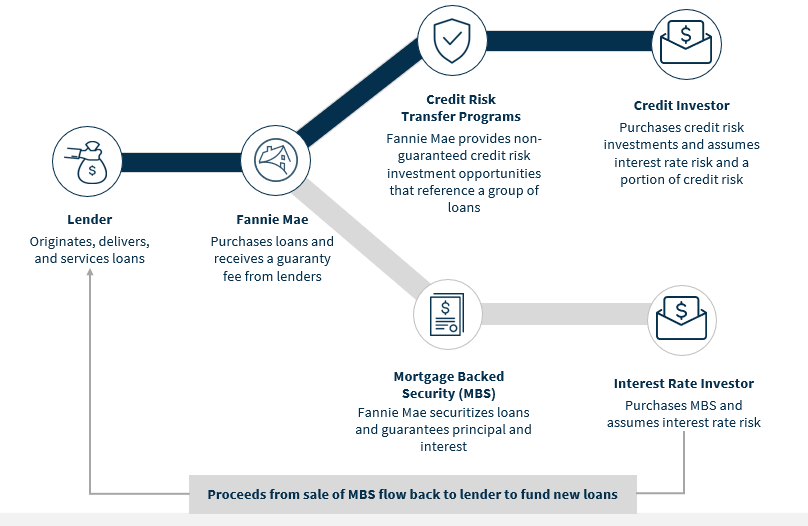

Through our credit risk transfer (CRT) transactions, we facilitate the flow of private capital between Fannie Mae's lender customers and a diverse group of investors.

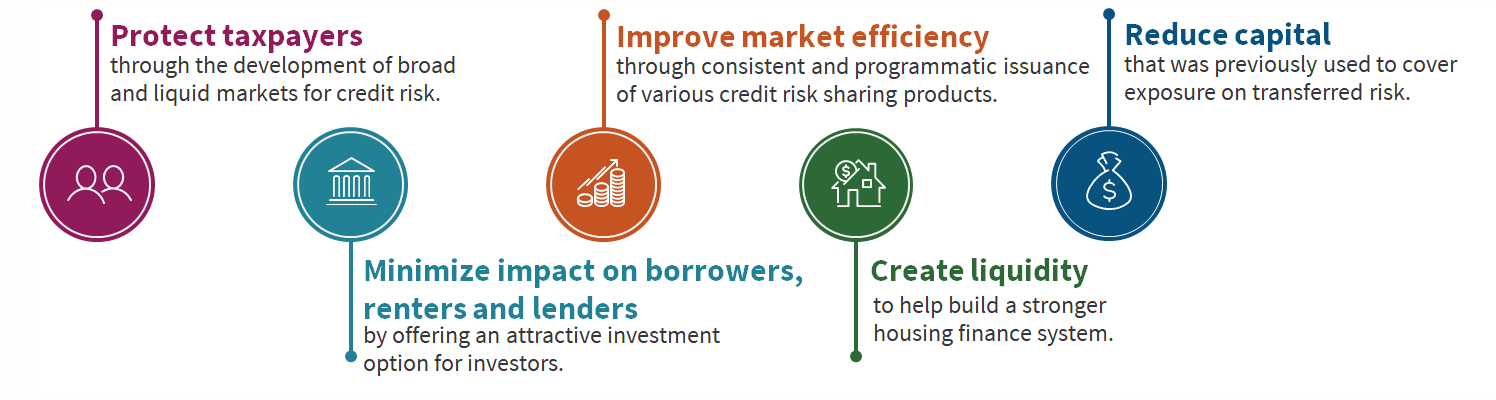

As the largest credit risk manager in the mortgage industry, we employ prudent standards and advanced technologies to acquire quality loans, prevent defaults, and reduce losses. We continuously evolve our CRT programs to broaden the types of loans covered and promote growth in the credit risk transfer market. Through our suite of credit risk transfer vehicles, we offer opportunities for investors to share in the credit performance of our book of business.

$3.44T of total unpaid principal balance of mortgage loans have been partially covered by Single-Family CRT vehicles at issuance as of Q4 2024.

In addition to DUS risk sharing, $198.8B of total unpaid principal balance of Multifamily mortgage loans, measured at the time of the transactions, has been covered through MCAS and MCIRT as of Q4 2024.

Our suite of credit risk transfer vehicles

To support the market demand for mortgage credit risk, we have developed multiple innovative forms of risk transfer and created a market for securitized mortgage credit risk. Our programs include:

Single-Family Credit Risk Management Vehicles

Connecticut Avenue Securities® (CAS)

Learn more about our CAS program, which pioneered a new credit risk market and is designed to share credit risk on a portion of our geographically diverse Single-Family book.

Learn moreCredit Insurance Risk Transfer™ (CIRT™)

Learn more about our CIRT program, designed to transfer risk to insurance providers, who in turn may transfer that risk to reinsurers.

Learn moreSeller-Servicer Risk Share

Learn more about our Seller/Servicer Risk Share transactions, which allow lenders to invest directly in credit risk on loans they originate and/or service.

Learn moreMortgage Insurance Risk Share

Learn more about our long-standing Mortgage Insurance Risk Share transactions, in which we purchase credit enhancements from mortgage insurance companies.

Learn moreMultifamily Credit Risk Management Vehicles

Delegated Underwriting and Servicing® (DUS®)

Learn more about DUS, our flagship program that requires lenders to retain some of the credit risk of the loans they sell to us — ensuring a stake in each loan's performance.

Learn moreMultifamily Credit Insurance Risk Transfer™ (MCIRT™)

Learn more about our MCIRT program, designed to complement our DUS program and transfer risk to reinsurers.

Learn moreMultifamily Connecticut Avenue Securities™ (MCAS™)

Learn more about our MCAS program, which leverages our existing credit risk transfer structure to reach a broader and more diverse investor base.

Learn more